Types of Alternative Investments | Complete Beginner’s Guide

“Diversify! Diversify! Diversify!” is the mantra on every investment advisor’s lips and we could not agree more on this. However, diversification has varied connotations across classes of investors. While regular investors are happy to be diversified through plain equities, bonds, and mutual funds, the High Net Worth individuals and institutions want diversification with a tiara of exclusivity. This is where Alternative Investments find their place.

We all love options, don’t we? With the emergence of Alternative assets, the investment arena is brimming with options like never before. Diversification and higher returns define the essence of alternative investments and one needs to put in thorough due diligence before parking funds in them.

We discuss the following in this article –

- Alternative Investments Definition

- Alternative Investments vs Traditional Investments

- Why Alternative Investments are Preferred?

- Private Equity

- Hedge Funds

- Venture Capital

- Real Estate/ Commodities

- Collectibles like Wine/ Art/Stamps

Alternative Investments Definition

Simply defined, Alternative investments are those asset classes that vary from traditional investments on grounds on complexity, liquidity, regulatory mechanism and mode of fund management. But that is too theoretical, isn’t it? Different types of alternative investments include Private Equity, Hedge Funds, Venture Capital, Real Estate/ Commodities and Tangibles like Wine/ Art/Stamps.

Let us delve a little further and understand what actually differentiates Alternative investments from the traditional ones.

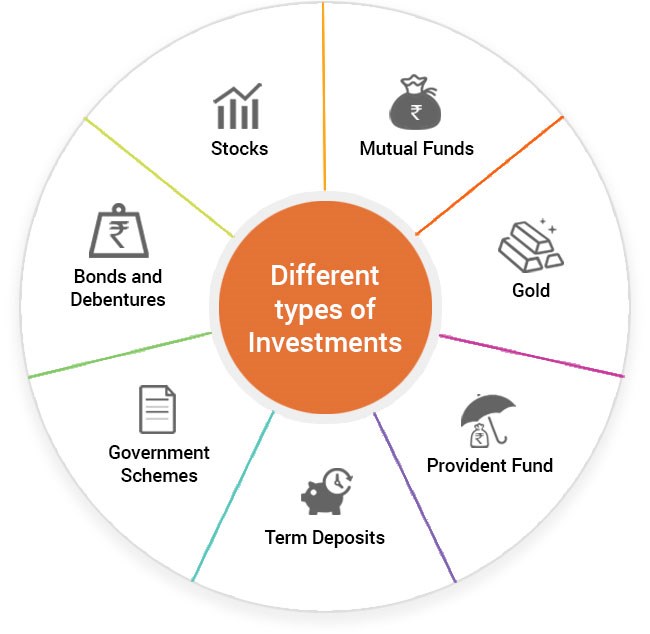

Alternative Investments vs Traditional Investments

As these are assets with a niche investor base, the trading in these are infrequent as compared to the traditional investments. Due to the low volume of trading and the absence of a public market, these investments cannot be sold off quickly. There is also a sheer lack of buyers who want to readily purchase the investments. This is in total contrast with the publicly traded stocks, mutual funds and fixed securities which are constantly being bought and sold due to a much wider investor base.

(NOTE: certain indices and ETFs which reflect the performance of the alternative assets are comparatively more liquid, however, this article only focuses on real assets and not indices. Hence, these are outside the scope of the article)

Less transparency and lower regulations:

While the investments are heavily regulated under the Dodd-Frank Wall Street Reform and Consumer Protection Act, they are not directly covered by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). While few of the Anti-fraud norms are applicable to alternative investments, there is no single agency that has defined regulatory norms for the Alternative space and monitors activities of the fund managers.

Limited performance indicators:

Due to the lower volume of trading, the data, facts, and figures pertaining to alternative Investments are difficult to obtain. While there are many sources floating on the internet, determining their credibility is a task. Investors of traditional investments have wider access to data, news, and research which helps him take decisions and formulate strategies, but for alternative investments, limited access to information and historical trends increases dependency on fund managers.

Close-ended funds

Alternative investments are mainly close-ended funds with an investment horizon of 10-15 years. Hedge Funds are the only exception of this and similar to traditional investments in this respect. In alternative investments, funds are not automatically reinvested but returned back to the investors after the time frame, who can then chose to invest it somewhere else.

Why Alternative Investments are Preferred?

Now the question arises, if these are investments with an air of ambiguity, why would high net worth investors want to have them in their portfolios and how would it benefit them?

Alternative investments as a domain are still evolving and maturing. While it is mainly considered to be a prerogative of the High Net Worth investors, there are also retail investors who are showing keen interest in them. After the financial crisis in 2008, where even the best of the diversified portfolios were swayed by extreme volatility, alternative investments proved their worth.

The major reasons why they score brownie points over traditional investments are:

A low co-relation with markets:

Low correlations to traditional asset classes like equity markets and fixed income markets act as a major advantage for alternative investments. These asset classes usually have a co-relation between -1 to 0 which makes them less susceptible to systematic risk or market-oriented risk element. However, a catch in this scene is the upside is also capped due to a low correlation with the market. Also, see CAPM Beta

A strong tool for diversification:

Alternative investments by virtue of their lower co-relation co-efficient offer better diversification benefits with enhanced returns. These assets perfectly complement the traditional investments and when a stock or bond underperforms, a hedge fund or private equity firm can cushion the extent of losses over the long term. One can add or replace alternative assets based on individual investment goals and risk appetite.

Active management:

As compared to the passive indexed investment, alternative investment calls for active management of funds. The complex nature of the assets, volatility and elevated risk level of these investments required constant monitoring and recalibration of investment strategies as needed. Moreover, the wealthy investors for whom high management fees are not a concern would definitely want to reap the benefits of high-end expertise.

There various types of Alternative investments. Few are well-structured, while few follow distinctiveness of the investors. Let us try to understand the structure and underlying philosophies behind these asset types.

Alternative Investments Types;

Private Equity'

Not all equities are listed on stock exchanges. Private Equity refers to funds that institutional investors or high net worth investors directly place in private companies or in the process of the buyout of public companies. Usually, these private companies then utilize the capital for their inorganic and organic growth. It can be for expanding their footprint, increasing the marketing operations, technological advancement or making strategic acquisitions.

Mostly the investors lack the expertise to select companies that suits their investment goals, thus they prefer investing through Private Equity Firms rather than the direct mode. These firms raise funds from high net worth investors, endowments, insurance companies, pension funds, etc.

When it comes to judging the performance of Private Equity, measures like IRR (Internal Rate of Return) were widely used, but it has certain limitations. IRR did not address the reinvestment element for interim cash flows or negative flows. Thus, evolved the Modified IRR. A more practical and holistic tool than the traditional IRR, the modified IRR or MIRR is the main measure to quantify the Private Equity performance these days. Also, checkout NPV vs IRR.

A quick look at Private Equity Fund structure:

| Limited Partner | General Partner | Compensation Structure |

| They are the institutional or high net worth individuals who invest in these funds | The General Partners are the ones responsible for managing the investments in the fund | The General Partners receive management fees as well as a share of profits on the investment. This is known as Carried Interest and ranges between 8% to 30% |

Hedge Funds

Mutual Funds are quite popular, but, Hedge Funds, its distant cousin, still belongs to a lesser-known territory. This is an alternative investment vehicle, which only caters to investors with ultra-deep pockets. As per US laws, hedge funds should cater only to “accredited” investors. This implies that they must possess a net worth of more than $1 million and also earn a minimum annual income. According to the World Economic Forum (WEF), Hedge funds have more than $3 trillion assets under management (AUM), which represents 40% of total alternative investments.

So why are they called Hedge Funds in the first place?

These funds derived this name due to their core idea to generate a consistent return and preserve capital, instead of focusing on the magnitude of returns.

With minimal co-relation to equity markets, most hedge funds have been able to diversify portfolio risks and reduce volatility.

Hedge funds are also the pool of underlying assets but they differ from Mutual Funds on a number of grounds. They are not regulated as Mutual Funds and hence have the leeway to invest in a broader range of securities. Hedge funds are best known for investments in risky assets and derivatives. When it comes to investment techniques, hedge funds prefer to take a more high-end complex approach calibrated to varying levels of risk and return. Many of them also resort to “Leveraged” investment, which means using borrowed money for investment.

One factor that distinguishes Hedge Funds from other alternative investments is its liquidity quotient. These funds can take as low as a few minutes for sell-off due to increased exposure to liquid securities.

Venture capital

We live in the age of entrepreneurship. New ideas and technological advancements have led to the proliferation of start-up ventures across the globe. But ideas aren’t enough for a firm to survive. To sustain, a firm needs capital. Venture Capital is an alternative asset class that invests equity capital in private start-ups and shows exceptional potential for growth.

Doesn’t it sound familiar to Private Equity? No, it doesn’t. Private Equity invests equity capital into mature companies, while Venture Capital is mainly for startups.

Venture Capital usually invests at seed and early-stage businesses while some invest at the expansion stage. The investment horizon is typically between 3-7 years and venture capitalists expect returns to the tune of >8x-10x the invested capital. This high rate of return is a natural outcome owing to the risk quotient associated with the investment. While some ideas might appear lacklustre in the inception stage, who knows, they may turn out to be the next Facebook or Apple? Investors who have the calibre to shoulder this level of risk and believe in the underlying potential of the idea are the ideal venture capitalists. Investing in new ventures involves a high degree of risk peppered with uncertainty. There are high possibilities of negative outcomes and this justifies the risk quotient. Each stage of Venture Capital investment presents a new risk, however, the returns generated are directly proportional to the quantum of risk, and that’s what lures the Venture Capitalists.

The risk/ Return element for Venture Capital according to the stage of investment.

Real assets

Collectables like wine, art, stamps or vintage cars

For those who thought stamps, artwork and vintage wine are just prestigious souvenirs, think again! Hidden in these connoisseurs are astute investors who know the real value of these collectables.

Classic cars like 1950 Ferrari 166 Inter Vignale Coupe and Ferrari 250 GTO Berlinetta tops the list, while investment-grade wines like Bordeaux come a close second. Coins, art, and stamp are some of the other luxury investments that also preferred options.

No comments:

Post a Comment