|

What is Put-Call Parity?

Put-Call Parity Example

Let’s take a look at two portfolios of an investor:

Portfolio A: A European call options for a strike price of $500/- which has a premium or price of $80/- and pays no dividend (impact of dividend is discussed later in the paper) and A zero-coupon bond (which pays only principal at the time of maturity) which pays Rs.500/- (or the strike price of call options) at maturity and,

Portfolio B: Underlying stock on which call options are written and a European put options having an identical strike price of $500/- which has a premium of $80/- and an identical expiry.

In order to calculate pay-offs from both the portfolios, let’s consider two scenarios:

- Stock price goes up and closes at $600/- at the time of maturity of an options contract,

- The stock price has fallen and closes at $400/- at the time of maturity of an options contract.

Impact on Portfolio A in Scenario 1: Portfolio A will be worth the zero-coupon bond I .e.$500/- plus $100/- from call options pay-off i.e. max(ST-X,0). Therefore, portfolio A will be worth the stock price (ST) at time T.

Impact on Portfolio A in Scenario 2: Portfolio A will be worth the share price i.e. $500/- since the stock price is less than the strike price (it is out of the money), the options will not be exercised. Hence, portfolio A will be worth stock price (ST) at time T.

Likewise, for portfolio B, we will analyze the impact of both scenarios.

Impact on Portfolio B in Scenario 1: Portfolio B will be worth the stock price or share price i.e. $600/- since the share price is lower than the strike price (X) and are worthless to exercise. Therefore, portfolio B will be worth the stock price (ST) at time T.

Impact on Portfolio B in Scenario 2: Portfolio B will be worth the difference between the strike price and stock price i.e. $100/- and underlying share price i.e. $400/-. Hence, portfolio B will be worth a strike price (X) at time T.

The above pay-offs are summarized below in Table 1.

Table: 1

When ST > X When ST < X Portfolio A Zero-Coupon bond 500 500 Call option 100* 0 Total 600 500 Portfolio B Underlying Stock (Share) 600 400 Put option 0 100# Total 600 500

*The pay-off of a call option = max(ST-X,0)

#The pay-off of a put option = max(X- ST,0)

In the above table we can summarize our findings that when the stock price is more than the strike price (X), the portfolios are worth the stock or share price (ST) and when the stock price is lower than the strike price, the portfolios are worth the strike price (X). In other words, both the portfolios are worth max(ST, X).

Portfolio A: When, ST > X, it is worth ST,

Portfolio B: When, ST < X, it is worth X

Since, both the portfolios have identical values at time T, they must, therefore, have similar or identical values today (since the options are European, it cannot be exercised prior to time T). And if this is not true an arbitrageur would exploit this arbitrage opportunity by buying the cheaper portfolio and selling the costlier one and book an arbitrage (risk-free) profit.

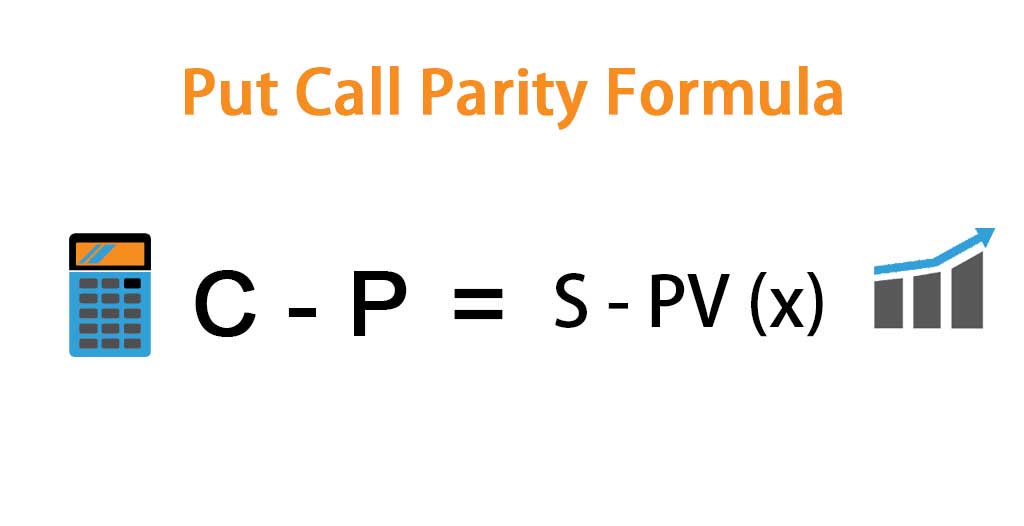

This brings us to a conclusion that today portfolio A should be equal to Portfolio B. or,

C0+X*e-r*t = P0+S0

This brings us to a conclusion that today portfolio A should be equal to Portfolio B. or,

C0+X*e-r*t = P0+S0

Arbitrage Opportunity through Put-Call Parity

Let’s take an example to understand the arbitrage opportunity through put-call parity.

Suppose, the share price of a company is $80/-, the strike price is $100/-, the premium (price) of a six-month call option is $5/- and that of a put option is $3.5/-. The risk-free rate in the economy is 8% per annum.

Now, as per the above equation of put-call parity, the value of the combination of the call option price and the present value of strike would be,

C0+X*e-r*t = 5+100*e-0.08*0.5

= 101.08

And the value of the combination of put option and share price is

P0+S0 = 3.5+80

= 83.5

Here, we can see that the first portfolio is overpriced and can be sold (an arbitrageur can create a short position in this portfolio) and the second portfolio is relatively cheaper and can be bought (arbitrageur can create a long position) by the investor in order to exploit arbitrage opportunity.

This arbitrage opportunity involves buying a put option and a share of the company and selling a call option.

Let’s take this further, by shorting the call option and creating a long position in put option along with share would require below calculated funds to be borrowed by an arbitrageur at risk-free rate i.e.

= -5+3.5+80

= 78.5

Hence, an amount of $78.5 would be borrowed by the arbitrageur and after six months this needs to be repaid. Hence, the repayment amount would be

= 78.5*e0.08*0.5

= 81.70

Also, after six months either the put or call option would be in the money and will be exercised and arbitrageur would get $100/- from this. The short call and long call put option position would, therefore, lead to the stock being sold for $100/-. Hence, the net profit generated by the arbitrageur is

= 100 – 81.70

= $18.30

The above cash flows are summarized in Table 2:

Table: 2

Steps involved in arbitrage position Cost involved Borrow $78.5 for six months and create a position by selling one call option for $5/- and buying one put option for $3.5/- along with a share for $80/-i.e. (80+3.5-5)

-81.7 After six months, if the share price is more than the strike price, the call option would be exercised and if it is below the strike price then put option would be exercised 100 Net Profit (+) / Net Loss (-) 18.3

i.e. (80+3.5-5)

No comments:

Post a Comment