What are Embedded Derivatives?

Example

Let us learn Embedded Derivatives with an example:

Let’s say there is an entity, XYZ Ltd., which issues bonds in the market. However, the payment of coupon and principal component of the bond is indexed with the price of Gold. In such a scenario the payment of the coupon will increase or decrease in direct correlation with the price of gold in the market. In this example, the bond issued by XYZ

In this example, the bond issued by XYZ Ltd. is the debt instrument (Non-derivative), while the payments are linked with another instrument which in this case is gold (Derivative component). This derivative component is known as an embedded derivative.

The non-derivative component here is also referred to as a host contract and the combined contract is hybrid in nature.

Uses of Embedded Derivatives

Embedded derivatives are used in many types of contracts. The most frequent use of the embedded derivative has been seen in leases and insurance contracts. It has also been seen that preferred stocks and convertible bonds also host embedded derivatives.

Usage in Risk Management

Embedded derivatives have been used in the risk management practices of any organization. Many organizations in the current working environment are paying production costs in one currency while they are earning revenue in another currency. In such situation organizations are opening themselves up to currency rate fluctuation risk. To protect themselves from such currency risk they hedge the same using different types of derivatives contracts available such as interest rate swaps, taking positions in futures and options. However, the same risk can be embedded in the sales contracts after a discussion with the client. Under such an arrangement the revenue can directly be linked with the production cost incurred by the company. This is a classic example of risk management using embedded derivatives. This makes the whole contract less risky for the company and also helps in taking clientele into confidence.

For many years it has been seen that interest rate derivatives (a type of embedded derivative instrument) are a good way to manage interest rate risk. However recently the trend has reduced because of the complex and complicated accounting measures in the space. The banks are now using variable-rate funding structures that have embedded derivatives.

Creating structured financial products

The embedded derivative methods allow the financial world to create structured complex financial products. In most of these cases, the risk component of one instrument is transferred to the return component of the other. The global financial markets have introduced many such products in the market in the last 20 to 30 years and this is the prime reason why understanding these products is very important.

Accounting for embedded derivatives

The requirement to account for certain embedded derivatives separately was originally intended to serve as an anti-abuse provision. The people who created these standards actually feared that entities might attempt to “embed” derivatives in contracts unaffected by the derivatives and hedging activities guidance so as to avoid its requirement to record the economics of derivative instruments in earnings. To provide consistency in accounting methods, the effort has been made in direction due to which embedded derivatives are accounted for in a similar manner compared to derivative instruments. For such a scenario a derivative that is embedded into the host contract needs to be separated and this process of separation is referred to as bifurcation. Let us understand this by an example.

Embedded Derivatives Accounting – Bifurcation

An investor in the convertible bond is required to separate the stock option component first by the process of bifurcation. The stock option portion which is an embedded derivative then needs to be accounted like any other derivative. This is done at the fair value level. However for the host contract accounting is done as per the GAAP standard, considering the fact that there is no derivative attached. Both the instruments are treated separately and accounted for as mentioned above.

However, it is very important to understand that not all embedded derivatives have to be bifurcated and accounted for separately. A call-option within a fixed-rate bond is a derivative that does not require bifurcation and separate accounting.

Criteria or situation which defines bifurcation?

- There are certain ways in which an embedded derivative needs to be treated for accounting purposes.

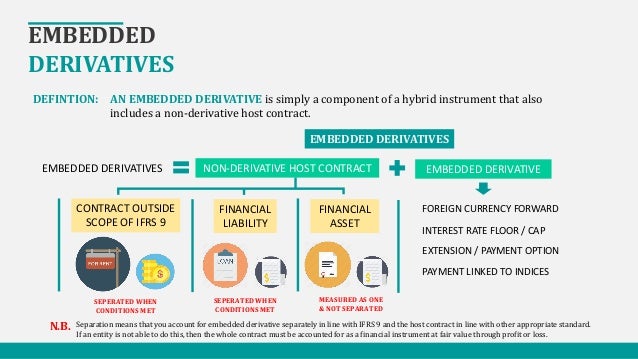

- As per the International Financial Reporting Standards (IFRS), the embedded derivative needs to be separated from the host contract and needs to be accounted for separately.

- This condition for accounting needs to be maintained unless the economic and risk characteristics of both the host contract and embedded derivative are closely related.

Embedded Derivatives Accounting Examples

Example 1:

Let’s say XYZ Ltd issues bonds in the market where the payment of coupon and principal is indexed with the price of Gold. In this case, we can see that the host contract does not have economic and risk characteristics associated with embedded derivatives (which is in this case price of gold). Hence, in this case, the embedded derivative needs to be separated from the host contract and needs to be accounted for separately.

Example 2:

Let’s say the same company XYZ Ltd issues bonds in the market where the payment of coupon and principal is indexed with the share price of the company. In this case, we can see that the host contract has economic and risk characteristics associated with embedded derivatives (which is in this case share price of the company). Hence, in this case, the embedded derivative need not be separated from the host contract and can be accounted for together. This is because of the fact that both have the same economic and risk characteristics.

Example 3

Let us learn the concept explained above numerically by means of another example. Let’s say that ABC corporation buys a $10,000,000 XYZ company convertible bond with a maturity period of 10 years. This convertible bond pays a 2% interest rate and the conversion details say that the bond can be converted to 1,000,000 shares of XYZ Company common stock, which shares are publicly traded. Under the accounting norms, the company must determine the value of the conversion option which is embedded in the debt instrument and then there is a need for separate accounting of it as a derivative. To account for it as a derivative the fair value estimation was done which showed the fair value of the bond stood at $500,000. This is arrived at using some kind of option pricing model.

ABC Corporation would pass the following journal entry for proper accounting:

Bond $10,000,000

Conversion option (at fair value) $500,000

Cash $10,000,000

Discount on Bond $500,000

Real-Life Examples

| Hybrid Instrument containing an embedded derivative | Identifying embedded derivative | Is the embedded derivative clearly and closely related to the host? | Bifurcation and separate accounting required for embedded derivative? |

| Floating rate bonds which has interest rate tied to interest index like LIBOR, prime rate, the repo rate | There is no case of embedded derivative in this situation | N/A | N/A |

| Fixed-rate bond with a fixed interest rate | There is no case of embedded derivative in this situation | N/A | N/A |

| Callable debt instrument: In this kind of debt instrument the issuer has the option to prepay. | Call option for the issuer to prepay debt instrument | Yes: Interest rate and call options are closely related. | No |

| Convertible debt investment: Investor has the option to convert the debt instrument into the equity of the issuer at an established conversion rate | A call option on issuer’s stock | No, the equity-based underlying is not closely related to debt instruments. However, there can be an exception when the equity shares of the entity do not trade in the market and hence no cash settlement can take place. | Yes. The embedded derivative will be recorded at the fair value and changes will be recorded in earnings. |

| Equity indexed Note: In such an instrument the return or principal and interest of the debt instrument is linked with an equity Index. | A forward exchange contract with an option tied with the specified equity index. | No, the forward contract or options contract and the debt instrument are not closely related. | Yes. The embedded derivative will be recorded at the fair value and changes will be recorded in earnings. |

| Credit Sensitive bond: the bond whose coupon rate that resets based on the changes in the credit rating of the issuer | A conditional exchange option contract that entitles the investor to a higher rate of interest if the credit rating of the issuer declines. | Yes, the creditworthiness of the debtor is clearly and closely related to the debt instrument. | No |

All the above-mentioned situations in the table are real-life financial instruments.

No comments:

Post a Comment