Growth Capital Meaning

Growth capital popularly known as expansion capital is capital provided to relatively mature companies that require money to expand or restructure operations or explore and enter new markets. So basically growth capital serves the purpose of facilitating target companies to accelerate growth.

Growth capital is placed on the gamut of private equity investing at the crossroads of venture capital and control buyouts.

In this article, we look at what is Growth Capital in detail –

- What a PE fund looks out for when doing Growth Capital investment?

- Growth Capital Deals Example

- #1 – Softbank investment in Uber Rival Grab – $750 mn

- #2 – Airbnb raises $447.8mn in series F round of funding

- #3 – Deliveroo raised $275 mn in round 5 funding

- #4 – In context Solutions raises $15.2 mn from Beringea.

- Minority Interests and Growth Capital

- Majority Interests and Growth Capital

- Growth Capital deal characteristics

- Structuring a Growth capital investment

- Growth Capital vs Venture Capital

- Growth Capital vs Controlled Buy-outs

- Conclusion

What a PE fund looks out for when doing Growth Capital investment?

When it comes to Growth capital these investments provide a different set of opportunities and challenges to PE investors. Not all PE investors would be interested, nor are they active in this area. Few of them are not permitted to invest and provide growth capital based on their fund documentation.

Why so? This is because PE funds would generally not be interested in opportunities that result in cash burn rate in the foreseeable future. This is so as the investors would have little appetite to fund working capital or cash requirements as an ongoing responsibility or to invest where there is a risk of future dilution.

When a PE fund wishes to do a growth capital investment they would be looking out for a concrete clear plan outlining the capital requirements. Although the requirements would be significantly huge but would be limited and specific such as generating substantial EBITDA growth, international expansion, etc.

Growth Capital Deals Examples

Let’s discuss the following examples.

#1 – Softbank investment in Uber Rival Grab – $750 mn

#2 – Airbnb raises $447.8mn in series F round of funding

Airbnb was able to raise $447.8mn in series F round of funding. Airbnb has in past expanded in the travel sector by launching Trips, which offer customers tours and related activities. It plans to add flights and services in the future.

#3 – Deliveroo raised $275 mn in round 5 funding

Food delivery service Deliveroo raised $275 mn in round 5 funding. This London based company is active in 12 countries in Europe, Asia, and the Middle East. This financing was led by experienced restaurant investor Bridgepoint along with existing investor Greenoaks Capital. The funds were procured for geographic expansion in new and existing markets as well as further investments in projects such as Roo-Box, which would give restaurants access to off-site kitchen space that will cater to the takeaway demand that cannot be supplied by their own restaurant kitchens.

#4 – In context Solutions raises $15.2 mn from Beringea.

In context Solutions successfully got $15.2 mn through Beringea. Beringea is a PE firm that is focused on providing growth capital. In-context Solutions is a global leader in virtual reality (VR) solutions for retailers and manufacturers. This capital would be utilized to accelerate sales, marketing efforts and expand its geographic footprint. It will also focus on improving VR product portfolio, and also include further development of solutions for head-mounted devices Of the total investment deals done in 2016 2% were for Growth capital/ Expansion as per pre in.

Minority Interests and Growth Capital

Growth investments would ideally take the form of significant minority interest. Compared to the traditional buy-out or traditional VC investment there is no single form of document that is used in such deals.

So what happens is that while some deals would be quite similar to late-stage VC investment other would have similar characteristics as that of a typical buyout. This would depend on the negotiation among the parties. This would also depend on PE investor’s earlier experience on growth capital and have a minority interest. As many investors are unaware of the dynamics of controlling interest so they would seek contractual rights else they would rely on their relationship with the management and forego their protective rights.

If the investors go for control rights then the investors would have these rights accompanied by the power to intervene when things go wrong or force an exit if the same doesn’t occur in the agreed investment window say for example 3 years from the initial investment. This scenario may cause friction especially if the founder is successful and has developed business at an early stage.

When an investor goes for growth capital then it is important that clarity is maintained on such matters. Clarity should be maintained on what would be the steps to be taken if there is friction among investors and founders or when the founder ceases to be involved in the business on an active basis. The key area of the debate would be transferring shares that are founder’s equity and ongoing shareholder protection and board rights of the founder when he decides to go in passive mode.

Majority Interests and Growth Capital

Sometimes there would be Majority Interest in the deal given to PE investor. However, this happens rarely. If this happens then the contract and investment would resemble classic buyout. There would be few differences around the operational features and capabilities of the company.

Compared to a mature buyout, most of the target companies wouldn’t be ready for the requirements of PE investors. It is quite unlikely of shareholder debt being re-payed during earlier years of investment. This would result in loan note-getting compounded. Also, these target companies wouldn’t have the right infrastructure to provide the requisite financial reporting to PE investors. Failure to comply with provisions of providing requisite financial information can lead to operational and economic consequences. In such a scenario, it is necessary that the agreements are drafted in such a manner that target companies have the time to develop the systems required for reporting.

Issues such as no HR policies in place, lack of health and safety compliance, data protection policies need to be in place when a PE investor would step in and invest. These issues would not break the deal between the two parties but would require operational change.

Any investor is looking out for profitable investments. PE investors would be interested in growth capital investments if the business has the potential and the investment is done at the crucial point of the growth curve of Target Company. Also, management of the finances is of utmost necessity for making the investments profitable.

Apart from financial performance, it will be necessary that issues such as those mentioned above are sorted so as to ensure that PE investor makes a successful exit, as a successful business is easy to sell or attractive enough to be introduced to public markets.

Growth Capital deal characteristics

Each deal would have specific terms. These terms would be decided on the basis of several key metrics such as past financial performance, operating history so far, market cap etc. However, these terms would be similar to the traditional deal made for late-stage venture capital financing.

The key characteristics would be -:

- Just like a deal with a venture capitalist, even in Growth Capital, the investor would acquire preferred security in the target company.

- These would be a minority stake using little leverage.

- The deal would give redemption rights that are designed to create liquidity on triggering events such as IPO

- The deal would be designed to give operational control over significant matters. These provisions give investors consent rights on the important transaction such as any debt or equity transactions, transactions relating to M&A, any change in tax/accounting policies, any deviations from budget/business plan, changes in key management personnel that hiring/firing, and other significant operational activities.

- The growth capital deal gives the investor rights such as tag-along rights, drag-along rights, and registration rights. These rights are given as deemed appropriate for the size and scope of the transaction and the lifecycle of the issue.

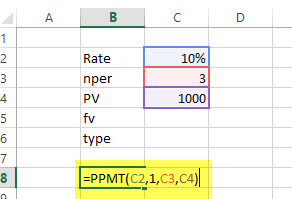

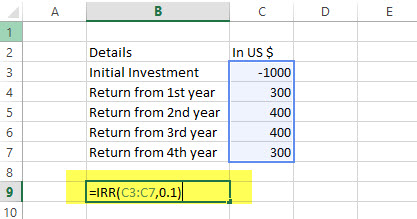

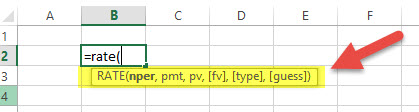

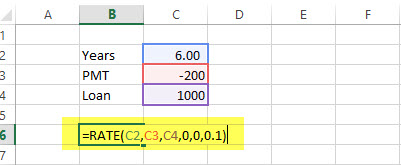

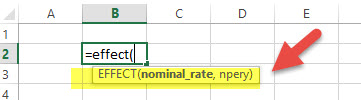

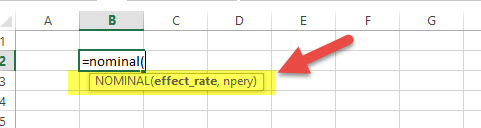

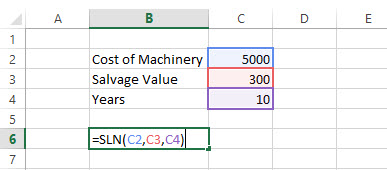

Structuring a Growth capital investment

Growth Capital vs Venture Capital

From the private equity investor’s perspective, there are several key distinctions between growth capital and venture capital These are -:

- Growth capital focuses on investing in mature companies whereas a VC would focus on early-stage companies who have an unproven business model.

- In the case of venture capital, investments are done in multiple early-stage companies of a specific industry or sector. However, Growth capital investment would do in a market leader or a perceived market leader within a specific industry or sector

- The investment theses in venture capital are underwritten on substantial growth projections of revenue of Target Company. However, when it comes to growth capital investment the investment logic is on the definite plan to achieve profitability potential.

- In Venture capital investments the future capital requirements are undefined. However, this would not be the case in growth capital investments that Target companies would have no or minimum future capital requirements.

Also, have a look at the difference between Private Equity vs Venture Capital.

Growth Capital vs Controlled Buy-outs

When it comes to growth capital it differs in several manners such as -:

- In control buyouts, the investment is a controlling equity position, whereas in Growth capital this is not the case.

- PE investors invest in highly profitable operating companies in controlled buy-outs. These are those companies that have free cash flow. However, growth capital investments are done in those companies that have limited or no Free Cash Flow

- Often in controlled buyouts debt financing is employed to leverage the investment. However, in growth capital investments the companies have no or minimum funded debt.

- An investment in controlled buy-outs is done at a point where there is growth stability that is projections point towards stable revenue & profitability. However, as mentioned above growth capital investments are done at a junction where the investment made will boost revenue and profitability of the target company.